Department of Production and Transportation Engineering – Federal University of Rio Grande do Sul – UFRGS, Porto Alegre, Rio Grande do Sul, Brazil.

doregoferreiralima.1@buckeyemail.osu.edu

Department of Management Sciences, Fisher College of Business – The Ohio State University, Columbus, OH, United States.

Goal: This study aims to assess the impact of using the method of real options in investment analysis through a case study on a retail firm.

Design / Methodology / Approach: It was targeted the applications of the real options method in a different type of environment and it was compared to another method more commonly used, the discounted cash flow method (DCF). The implementation and assessment of the real options method was investigated by means of a case study conducted in an investment analysis in a retail units firm.

Results: The use of the real options method showed a more concise applicability over the DCF method. The results show that the project’s value, after the inclusion of managerial flexibility, increased significantly, which indicates that the analysis of the discounted cash flow undervalued the investment in question, since it disregarded the flexibility to expand or abandon the project.

Limitations of the investigation: The presented method is proper to long-term processes where it is possible to make changes during the project. Investments in this sector usually are more related to short and medium-term decisions, making the application difficult due to the short decision-making period available to the managers.

Practical Implications: The study provided the incorporation of flexibility through different pathways during the building project in a retail units firm. It was showed different scenarios where practitioners could decide among expanding, proceeding, reducing or abandoning the retail units based on the characteristics of their investments.

Originality/value: The results obtained are an indication of this methodology to industrial businesses that are relatively volatile and that need a certain degree of flexibility in order to burgeon, such as the case of the retailing sector.

Keywords: Investment analysis; Decision making; Managerial flexibility; Real options method; Case study.

Factors such as competitiveness, competition and increasing market demands typically require the business environment a more specific planning in which the decision-making process is done through assessment methods. These assessment methods serve to support decision making and are significantly important for companies in order to consider all possible investment alternatives (Liu et al., 2012; Keller et al., 2017). Traditional investment analysis tools ignore a relevant principle of many investment projects that is to allow project delay, the possibility of expansion or even discontinuation, when the project has already been started (Bodie and Merton, 1999; Scotelano et al., 2017). Without estimating these options, there is a great chance that the project’s Net Present Value (NPV) will be underestimated by the analyst.

Questions, such as what path to follow, which project to choose, how costs and revenues will be generated, as well as the capital needed, should all be considered in deciding on the best plan to follow (Casarotto Filho and Kopittke, 2008). Hence, an alternative approach that can be adopted is known as the assessment of real options (Borges et al., 2018; Lambrecht, 2017; Andalib et al., 2018).

In a nutshell, the theory of real options, when applied to projects with associated intangibles, tries to overcome the limitations of the conventional criteria and the lack of analytical discipline, which characterizes the qualitative assessment (Samanez, 1994; Fernandes et al., 2011; Lambrecht, 2017). This theory encompasses the investment opportunity as finance and business strategies. Hence, it creates an assessment tool supported by a quantitative approach that transforms the investment into financial options. The main objectives of this paper are to analyze the impact of real options by means of a case study conducted in a distribution center opening for retail units and to evaluate whether the investments should be expanded, abandoned, contracted or continued. Although the usefulness of this work serves to enhance the academic comprehension of the subject matter, it is believed that it is the practical community who will greatly benefit from this study, since they will have a hands-on and detailed vision of how the Real Options method was conducted.

The remainder of this paper is structured as follows. First, the authors’ theoretical background section “Theoretical Background” will be introduced to the concepts and the main literature on Real Options. After this, the study’s methodological procedures will be explained on the section “Methodology”. In the section “Results” the results of this case study will be presented. Finally, the authors’ discussions and conclusions will be presented on the section “Discussions and conclusions”.

As most part of the literature advocates, the main objective of companies should be the creation of a system in which managers make investments that maximize the long-term value of their companies (Porter, 1991; Cooper et al., 2001; Grillo et al., 2018). In order to analyze project options, it is necessary to verify whether the economic analysis of investments is centered on the elaboration of a cash flow that reflects all the inflows and outflows of the firm’s resources, that is, the elaboration of an estimative of both revenue and benefits when considering the costs of a new project (Lambrecht, 2017; Andalib et al., 2018). Most decisions made about investments involve three important factors: (i) if the investment is partially or completely irreversible; (ii) if there is uncertainty about future return, and (iii) if the investment is flexible, which comprehends the possibility of the investment to be postponed so that more information on the main points that affect the return of the investment itself can be obtained.

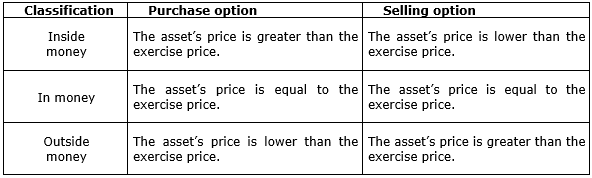

The option assessment theory makes it possible to capture the different paths that a company's management could take during the investment phase (Lambrecht, 2017). Moreover, it takes into account the uncertainties of the investment outcomes. In this way, an “option” can be defined as a contract that gives the buyer a future right over an asset, although there is no obligation to buy or sell it at a previously established price, the so-called “exercise price” (Andalaft-Chacur et al., 2011; Trigeorgis and Tsekrerkos, 2018). There are two types of options: the purchase, in which it is offered the right, but not the obligation to buy a given asset, and the sale, which offers the same conditions of buying, for the selling of a given asset. The option market allows the use of various strategies, some for protection, and others for speculation. Among the main reasons for using the option strategy are: (i) the obtaining of greater returns through the leverage aspect and (ii) the pricing of a future acquisition, allowing the acquisition of an asset with an attractive price on the current date at the same value in later periods, and to protect against falling prices. Regarding the performing possibilities, the classification can be made according to Figure 1.

Figure 1. Classification of the options according to the preforming possibility

Source: Adapted from Silva Neto and Tagliavini (1996).

The greatest problem in the decision to invest or to abandon a project is the duration devoted for the decision-making process (Martinsuo and Lehtonen, 2007; Liu et al., 2012; Scotelano et al., 2017). Typically, this duration, may delay the project, consequently, hampering the effectiveness of the decision itself. Thus, the real options theory brings flexibility as an advantage over the NPV method, because it presents explicit criteria for the decision as to when operations should be started, finished or discontinued. According to Copeland and Antikarov (2002), the NPV offers a decision of the present expectation about the future data. In contrast, the evaluation by real options provides the necessary flexibility for the decision making according to data availability.

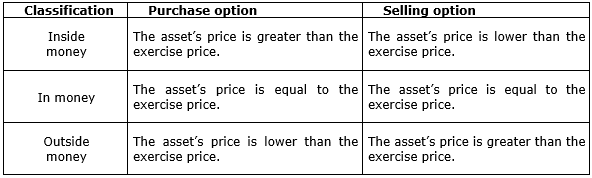

The economic analysis through real options is an investment analysis methodology that incorporates managerial flexibility, uncertainty and learning. One of the major benefits of such a methodology is the appreciation of decisions that would otherwise not be considered in a project, such as postponement, discontinuation and expansion, to mention but a few. This methodology, nevertheless, does not reject the discounted cash flow model, but rather it complements it by adding the value of the built-in opportunities with the resulting NPV (Miranda Filho, 2005). Literature provides some relevant applications regarding this topic. Figure 2 brings some applications and the main authors that have studied the real options theory.

Figure 2. List of authors per year and their real options theory applications.

Adapted from Santos and Pamplona (2001).

Among the listed authors on Figure 2, Brennan and Schwartz (1985), Dixit and Pindyck (1994) and Dias (1996), are the ones who mostly contributed to the field of Real Options. They not only extended the theoretical understanding on the topic, but also conducted studies related to the application of the real options method for investment analysis. In addition, some other authors who also largely contributed to the development of this method in different scenarios are Fuss et al. (2008), Reniers et al. (2011) and Szolgayová et al. (2011). Lastly, it could be verified that besides contributing to the analysis of investments, the theory of real options also serves to solve socio-economic problems (Kogut and Kulatilaka, 1994).

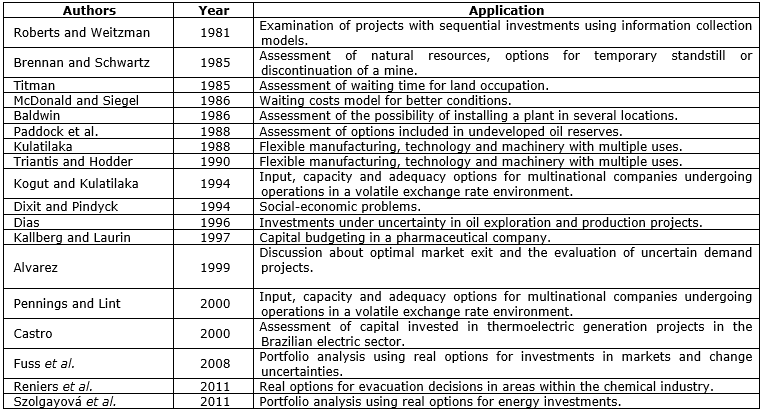

The present analysis consists in a case study made on a retail company. The identity of the company will be kept confidential, as requested by the company’s management. Hence, for discussions about this work, the data used in this study were transformed, without changing the final outcomes. The case encompasses an investment assessment in the opening of a retail unit in a new location. For this purpose, it will be necessary to open a local merchandise distribution center with small capacity. The other part of the operation will be served by distribution centers from other locations. For a possible expansion, it would be necessary to set up a permanent distribution center with a considerably high investment value. If the company decides to reduce the operation in the new location, this local distribution center would become, consequently, inactivated, and the operation in the region would be carried out by a distribution center in another distant location. This would negatively impact the operating margin. Hence, the primary objective of the analysis is to evaluate the impact of real options method used in the investment under analysis. For this purpose, an assessment will be performed firstly using the discounted cash flow method. Then, the same investment will be analyzed using the real options method. As seen in Figure 3, the real options assessment method employed follows previous works of Copeland et al. (2002) and consists of four steps:

Figure 3. The four Real Options Method steps

Source: Adapted from Copeland et al., 2002.

The first step consists in discounting the projected future cash and flow projections using a rate that reflects the risks tied to the project. The cash flow is used to identify the actual generation of project value, once Damodaran (2002) points out that book values do not demonstrate the actual outflows and inflows to shareholders.

The second step encompasses the elaboration of the event tree considering the degree of project’s uncertainty. For this, it is necessary to estimate the project’s variance, which can be done in three ways: (i) using the variance of the projects already carried out that resemble the project under analysis; (ii) using project estimates of other companies operating in the same sector and assigning different probabilities to different market situations; (iii) estimating the cash flow of the project in each case and estimating the variance in relation to the present value (Damodaran, 2002). For this study, the first option will be adopted, since the company already has a portfolio of other similar projects.

For the construction of the event tree, the initial value is multiplied by the upward [u] and downward [d] movement factors given by the following formulas:

where, σ is the estimated project volatility.

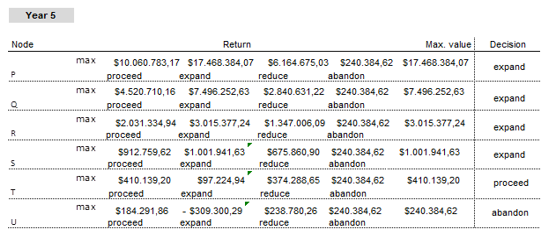

After the construction of the event tree, there is the third stage of the analysis, which corresponds to the incorporation of flexibility aspects. Firstly, the values were all converted to dollar. The dollar-real quotation was $1.00 to R$ 3.12 by the time the study was conducted. This study considers three flexibilities: (i) to expand the operation in 100%, with additional investment of $ 641,025.64; (ii) to reduce the operation by 40%, with a gain of $ 128,205.00; (iii) and to discontinue the project, with a gain of $ 240,385.00. The next step corresponds to the calculation of the risk-adjusted probability, given by:

where r is the risk-free interest rate.

Using the risk-adjusted probabilities, the decision tree must be constructed with the inclusion of the optimal management flexibilities at each node. The analysis of optimal choices should be made starting at the final nodes. Then, the final value of the project is calculated, composed of the value without managerial flexibility plus the value of the option:

Where n_1 e n_2 correspond to the optimal choices’ values of the Year 1 nodes.

This final value obtained is then compared to the present value of the project obtained through the discounted cash flow method.

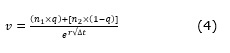

The cash flow estimation of the project was based on the company's business model, using a standard model developed by the project department for the analysis of this type of investment. Figure 3 shows the cash flow estimation for 5 years. The model is monthly updated, with assumptions aligned with the monthly forecast model of the company. The model contemplates more than 200 variables and has a very high level of assertiveness.

Figure 4. Cash flow summary.

Source: the authors’ own (2018).

After the cash flow calculations, the project assessment was carried out through the discounted cash flow. The perpetuity used in the calculation experienced a 5% growth. The weighted average cost of the capital adopted follows other similar projects conducted inside the company (18.40%). The NPV obtained was $1,361,655.61 and the IRR was about 40%.

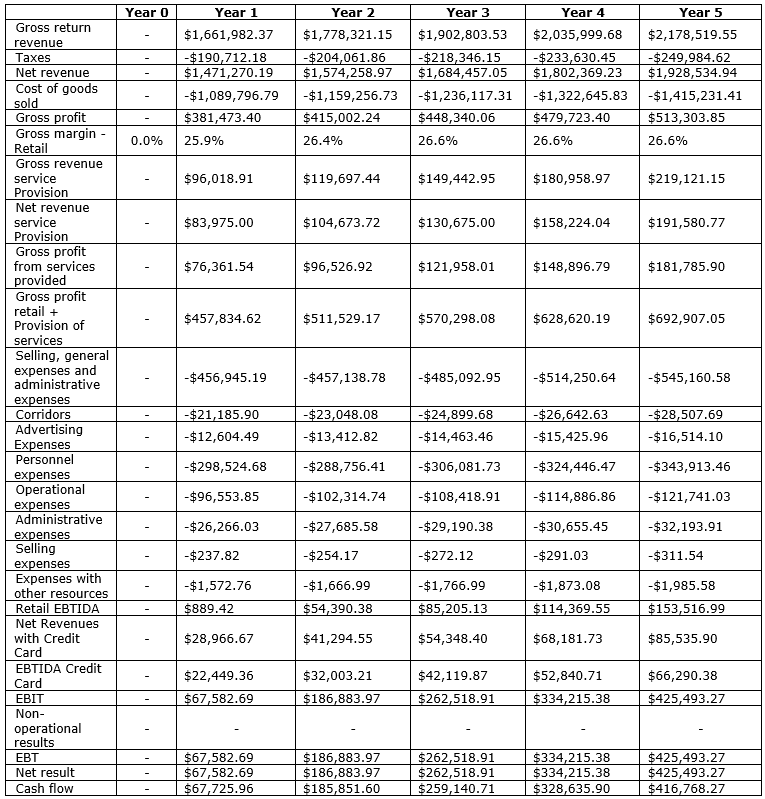

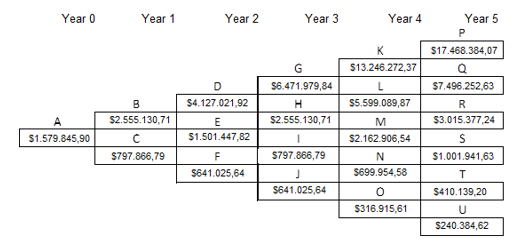

For the real options analysis, it is necessary to define the project’s volatility. As described in the methodology, a 40% degree of volatility was adopted in this study, which can also be found in data from previous and similar projects. Furthermore, the risk-free rate considered is 14.4%, and the values found for “u” and “d” are 1.492 and 0.670 respectively. Using this data, we have the following resulting event tree in Figure 5:

Figure 5. Event tree.

Source: the authors’ own (2018).

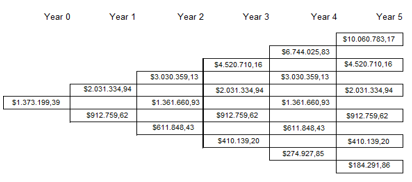

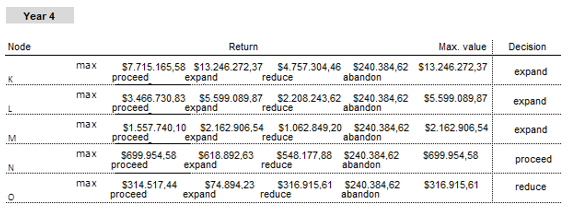

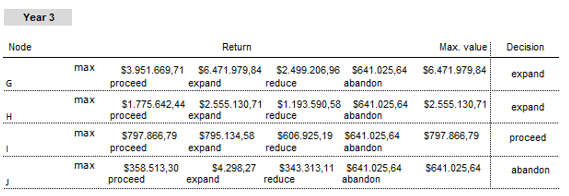

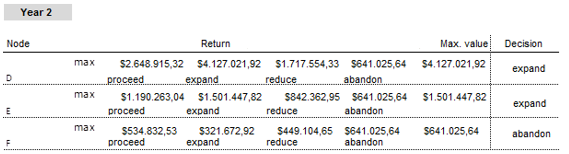

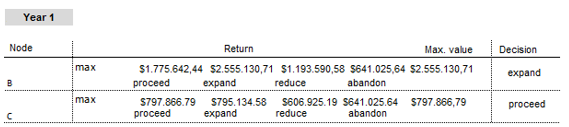

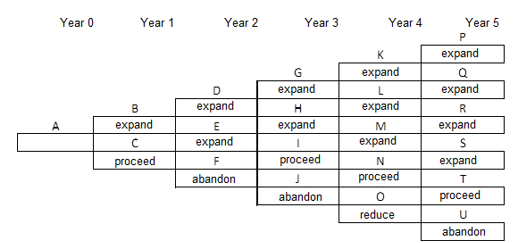

After the construction of the event tree (Figure 5), the decision tree was obtained with the inclusion of the three managerial flexibilities. The three managerial flexibilities included are: to expand by 80%, with the additional investment of $641,025.64; contracting, with a reduction of 60% and a gain of $128,205.00; and discontinue, with a gain of $240,385.00. The optimal decisions were obtained in each node, from the end nodes, as seen in Figures 6 to 10:

Figure 6. Year 5.

Source: the authors’ own (2018).

Figure 7. Year 4.

Source: the authors’ own (2018).

Figure 8. Year 3.

Source: the authors’ own (2018).

Figure 9. Year 2.

Source: the authors’ own (2018).

Figure 10. Year 1.

Source: the authors’ own (2018).

The optimum choices and the results at each moment are illustrated by the decision trees in Figures 11 and 12:

Figure 11. Values in decision tree.

Source: the authors’ own (2018).

Figure 12. Decisions in decision tree.

Source: the authors’ own (2018).

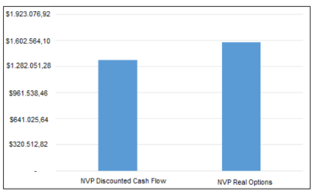

Finally, the calculation of the project’s final value was made encompassing the options value which was priced using the binomial method. The result obtained was $1,579,845.90. The difference between the new present value calculated through the real options theory and the present value obtained by the discounted cash flow shown in Figure 13 is $218,185.00, which corresponds to an increase of 16.02%.

Figure 13. NPV comparison.

Source: the authors’ own (2018).

The results show that the option to expand investments is presented several times in the decision tree. The decision to contract is the less advantageous one. The NPV increase of the project was significant (16%), which, in the company’s case, could be decisive for its inclusion in the investment portfolio. In this way, it is important to adopt methods that take into account managerial flexibilities, especially in the case presented, given the great volatility and dynamism of the retail segment.

The use of the real options theory allowed a better assessment of the possible returns achieved along the years in which the project takes place. The traditional method of project financial viability analysis through discounted cash flow underestimates the value of the project analyzed and does not consider possible alternatives for the investor, such as expanding or discontinuing the project. The value of the project’s flexibility is $218,185.00, which corresponds to a 16% increase over the amount calculated by the discounted cash flow. In this study, however, it was investigated a new approach for the same situation and, according to the results presented, it has been found that the implementation of the real options method for investment analysis and assessment is the best option for the case. The results obtained are an indication of this methodology to industrial businesses that are relatively volatile and that require a certain degree of flexibility in order to burgeon, such as the case of the retailing sector. Although investments in this sector may be more related to short and medium-term decisions, the opening of new units in new locations has a characteristic of being a long-term process and usually demands a great level of attention. Furthermore, the process characterizes a long-term decision, since it requires massive investments and usually takes more time to get fully established. Therefore, given the nature of the project management, it is better for the business as a whole to incorporate flexibility and adaptability. In addition, the dynamism of the sector makes it appropriate to incorporate flexibility into the analyzes.

Finally, the outcome of this study is in accordance to previous studies (Kallberg and Laurin, 1997; Alvarez, 1999; Reniers et al., 2011; Szolgayová et al., 2011). These works indicate a clear advantage of the Real Options Method use over others (in the case, the discounted cash flow method was compared), because it allows more extreme decisions to be taken. Differently from these previous studies on Real Options (e.g. Klingebiel and Adner, 2015; Trigeorgis and Reuer, 2017), the main objective of this work was to contribute to the literature with a more practical view of the subject. Furthermore, future studies are recommended to analyze the applicability of the Real Options method in other types of industrial businesses, with different levels of accuracy and demand for flexibility. It is believe that the incorporation of this method in other environments can bring substantial contributions in terms of the type of business that are more suitable and, consequently, more likely to benefit from the implementation of the Real Options Method.

Alvarez, L. H. (1999), “Optimal exit and valuation under demand uncertainty: A real options approach”, European Journal of Operational Research, Vol. 114, No. 2, pp. 320-329. DOI: https://doi.org/10.1016/S0377-2217(98)00259-8

Andalaft-Chacur, A., Ali, M. M., & Salazar, J. G. (2011), “Real options pricing by the finite element method”, Computers & Mathematics with Applications, Vol. 61, No. 9, pp. 2863-2873. DOI: https://doi.org/10.1016/j.camwa.2011.03.070

Andalib, M. S., Tavakolan, M., & Gatmiri, B. (2018), “Modeling managerial behavior in real options valuation for project-based environments”, International Journal of Project Management, Vol. 36, No. 4, pp. 600-611. DOI: https://doi.org/10.1016/j.ijproman.2018.02.001.

Baldwin, C. Y. (1986), “The capital factor: Competing for capital in a global environment”, In: Porter, M. E. (Ed.), Competition in Global Industries, Harvard Business Scholl, pp. 184-223.

Bodie, Z., & Merton, R. C. (1999), Finanças, Prentice Hall, São Paulo.

Borges, R. E. P., Dias, M. A. G., Neto, A. D. D. et al. (2018), “Fuzzy pay-off method for real options: The center of gravity approach with application in oilfield abandonment”, Fuzzy Sets and Systems, Vol. 355, pp. 111-123. DOI: https://doi.org/10.1016/j.fss.2018.03.008

Brennan, M. J., & Schwartz, E. S. (1985), “Evaluating natural resource investments”, Journal of Business, Vol. 58, No. 2, pp. 135-157. DOI: 10.1086/296288

Casarotto Filho, N., & Kopittke, B. H. (2008), Análise de investimentos, Atlas, Rio de Janeiro.

Castro, A. (2000), “Avaliação de investimento de capital em projetos de geração termoelétrica no setor elétrico brasileiro usando a teoria das opções reais”, Dissertação de Mestrado em Engenharia da Produção, Departamento de Engenharia Industrial, Pontifícia Universidade Católica, Rio de Janeiro.

Cooper, R., Edgett, S., & Kleinschmidt, E. (2001), “Portfolio management for new product development: results of an industry practices study,” R&D Management, Vol. 31, No. 4, pp. 361-380. DOI: https://doi.org/10.1111/1467-9310.00225

Copeland, T. E., & Antikarov, V. (2002), Opções reais: um novo paradigma para reinventar a avaliação de investimentos, Campus, Rio de Janeiro.

Copeland, T. E., Koller, T., & Murrin, J. (2002), “Unternehmenswert: Methoden und Strategien für eine wertorientierte Unternehmensführung”, In: Boersch C., Elschen R. (eds), Das Summa Summarum des Management, Gabler. DOI: 10.1007/978-3-8349-9320-5_28

Damodaran, A. (2002), Finanças corporativas aplicadas: manual do usuário, Bookman, Porto Alegre.

Dias, M. A. G. (1996), “Investimento sob incerteza em exploração de petróleo”, Dissertação de Mestrado em Engenharia, Departamento de Engenharia Industrial, Pontifícia Universidade Católica, Rio de Janeiro.

Dixit, A. K., & Pindyck, R. S. (1994), Investment under Uncertainty, Princeton University Press.

Fernandes, B., Cunha, J., & Ferreira, P. (2011), “The use of real options approach in energy sector investments”, Renewable and Sustainable Energy Reviews, Vol. 15, No. 9, pp. 4491-4497. DOI: https://doi.org/10.1016/j.rser.2011.07.102

Fuss, S., Szolgayova, J., Obersteiner, M. et al. (2008), “Investment under market and climate policy uncertainty”, Applied Energy, Vol. 85, No. 8, pp. 708-721. DOI: https://doi.org/10.1016/j.apenergy.2008.01.005

Grillo, H., Mula, J., Martínez, S. et al. (2018), “Key Parameters for the Analysis Stage of Internationalization of Operations”, Brazilian Journal of Operations & Production Management, Vol. 15, No. 2, pp. 173-181. DOI: https://doi.org/10.14488/BJOPM.2018.v15.n2.a1

Kallberg, G., & Laurin, P. (1997), “Real Options in R&D Capital Budgeting-A case study at Pharmacia & Upjohn”, Economics, Gothenburg School of Economics and Commercial Law, Gothenburg.

Keller, F. H., Daronco, E. L., & Cortimiglia, M. (2017), “Strategic tools and business modeling in an information technology firm”, Brazilian Journal of Operations & Production Management, Vol. 14, No. 3, pp. 304-317. DOI: https://doi.org/10.14488/BJOPM.2017.v14.n3.a4

Klingebiel, R., & Adner, R. (2015), “Real options logic revisited: The performance effects of alternative resource allocation regimes”, Academy of Management Journal, Vol. 58, No. 1, pp. 221-241. DOI: https://doi.org/10.5465/amj.2012.0703

Kogut, B., & Kulatilaka, N. (1994), “Operating flexibility, global manufacturing, and the option value of a multinational network”, Management Science, Vol. 40, No. 1, pp. 123-139. DOI: https://doi.org/10.1287/mnsc.40.1.123

Kulatilaka, N. (1988), “Valuing the flexibility of flexible manufacturing systems”, Transactions on Engineering Management, Vol. 35, No. 4, pp. 250-257. DOI: 10.1109/17.7447

Lambrecht, B. M. (2017), “Real options in finance”, Journal of Banking & Finance, Vol. 81, pp. 166-171. https://doi.org/10.1016/j.jbankfin.2017.03.006.

Liu, Y., Yi, T. H., & Wang, C. Q. (2012), “Investment decision support for engineering projects based on risk correlation analysis”, Mathematical Problems in Engineering, Vol. 2012, 242187. DOI: http://dx.doi.org/10.1155/2012/242187

Martinsuo, M., & Lehtonen, P. (2007), “Role of single-project management in achieving portfolio management efficiency”, International Journal of Project Management, Vol. 25, No. 1, pp. 56-65. DOI: https://doi.org/10.1016/j.ijproman.2006.04.002

McDonald, R., & Siegel, D. (1986), “The value of waiting to invest”, The Quarterly Journal of Economics, Vol. 101, No. 4, pp. 707-727. DOI: 10.2307/1884175

Miranda Filho, J. (2005), “Investimento em distribuição utilizando opções reais”, Dissertação de Mestrado em Engenharia Elétrica, Universidade Federal de Itajubá, Itajubá, MG.

Paddock, J. L., Siegel, D. R., & Smith, J. L. (1988), “Option valuation of claims on real assets: The case of offshore petroleum leases”, The Quarterly Journal of Economics, Vol. 103, No. 3, pp. 479-508. DOI: 10.2307/1885541

Pennings, E., & Lint, O. (2000), “Market entry, phased rollout or abandonment? A real option approach”, European Journal of Operational Research, Vol. 124, No. 1, pp. 125-138. DOI: https://doi.org/10.1016/S0377-2217(99)00121-6

Porter, M. E. (1991), “Towards a dynamic theory of strategy”, Strategic Management Journal, Vol. 12, S2, pp. 95-117. DOI: https://doi.org/10.1002/smj.4250121008

Reniers, G. L., Audenaert, A., Pauwels, N. et al. (2011), “Empirical validation of a real options theory based method for optimizing evacuation decisions within chemical plants”, Journal of Hazardous Materials, Vol. 186, No. 1, pp. 779-787. DOI: 10.1016/j.jhazmat.2010.11.061

Roberts, K., & Weitzman, M. L. (1981), “Funding criteria for research, development, and exploration projects”, Econometrica: Journal of the Econometric Society, pp. 1261-1288. DOI: 10.2307/1912754

Samanez, C. P. (1994), “Análise e gestão de projetos de investimento: uma aplicação da teoria das opções em projetos de exploração de recursos naturais”, Tese de Doutorado em Administração de Empresas, Fundação Getúlio Vargas, São Paulo.

Santos, E. M., & Pamplona, E. D. O. (2001), “Teoria das opções reais: uma abordagem estratégica para análise de investimentos”, XXI Encontro Nacional de Engenharia de Produção, Salvador, Bahia.

Scotelano, L. S., Conceição, R. D. P., Costa Leonídio, U. et al. (2017), “Project management maturity model: the case in an automotive industry in Brazil”, Brazilian Journal of Operations & Production Management, Vol. 14, No. 4, pp. 500-507. DOI: https://doi.org/10.14488/BJOPM.2017.v14.n4.a6

Silva Neto, L. D. A., & TagliavinI, M. (1996), Opções: do tradicional ao exótico, 2 ed., Atlas, São Paulo.

Szolgayová, J., Fuss, S., Khabarov, N. et al. (2011), “A dynamic CVaR‐portfolio approach using real options: an application to energy investments”, European Transactions on Electrical Power, Vol. 21, No. 6, pp. 1825-1841. DOI: 10.1109/EEM.2009.5207184

Titman, S. (1985), “Urban land prices under uncertainty”, The American Economic Review, Vol. 75, No. 3, pp. 505-514. Available from: http://www.jstor.org/stable/1814815.

Triantis, A. J., & Hodder, J. E. (1990), “Valuing flexibility as a complex option”, The Journal of Finance, Vol. 45, No. 2, pp. 549-565. DOI: 10.2307/2328669

Trigeorgis, L., & Reuer, J. J. (2017), “Real options theory in strategic management”, Strategic Management Journal, Vol. 38, No. 1, pp. 42-63. DOI: https://doi.org/10.1002/smj.2593

Trigeorgis, L., & Tsekrekos, A. E. (2018), “Real options in operations research: A review”, European Journal of Operational Research, Vol. 270, No. 1, pp. 1-24. DOI: https://doi.org/10.1016/j.ejor.2017.11.055

Received: 13 Nov 2018

Approved: 26 Feb 2019

DOI: 10.14488/BJOPM.2019.v16.n4.a2

How to cite: Benitez, G. B.; Lima, M. J. R. F. (2019), “The real options method applied to decision making – an investment analysis”, Brazilian Journal of Operations & Production Management, Vol. 16, No. 4, pp. 562-571, available from: https://bjopm.emnuvens.com.br/bjopm/article/view/633 (access year month day).